News

Ecobonus - What is energy requalification?

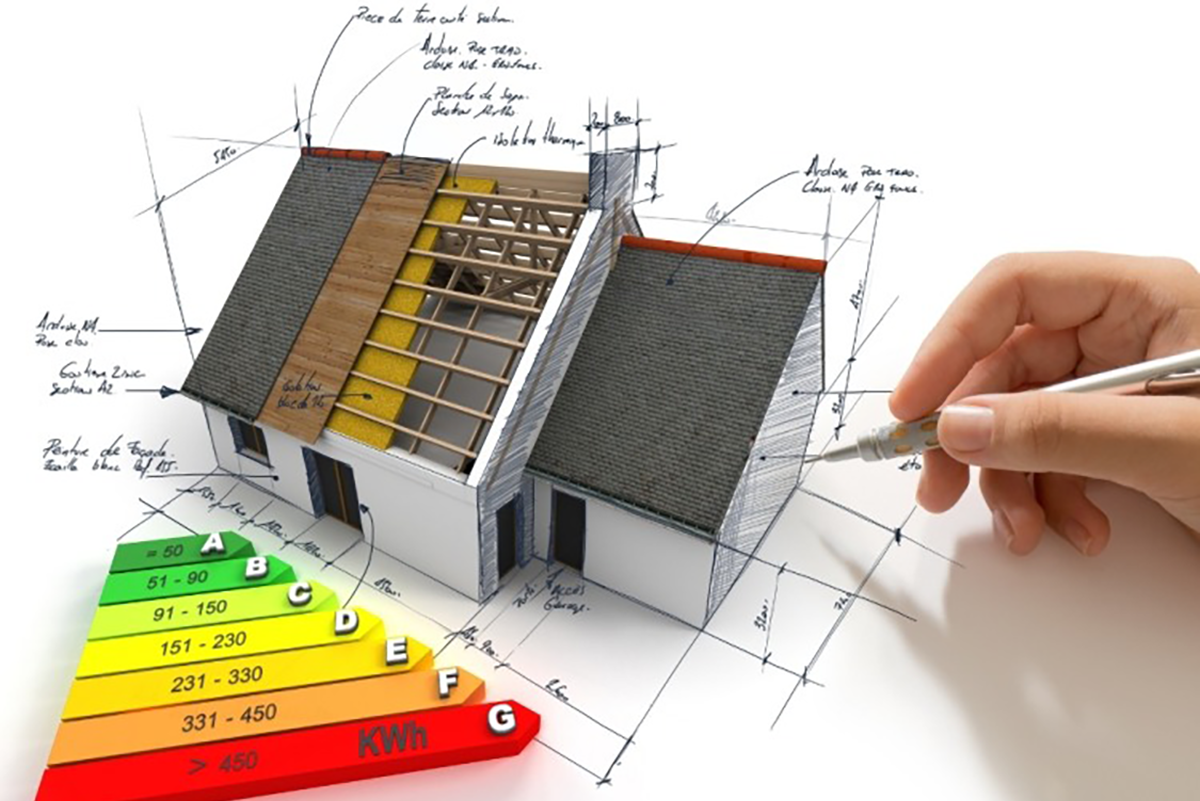

The relief consists of a tax deduction from the Personal Income Tax (IRPEF) or from the Corporate Income Tax (IRES) and is granted when interventions are carried out aimed at improving the energy efficiency of existing buildings. In general, tax deductions are recognized for the following interventions:

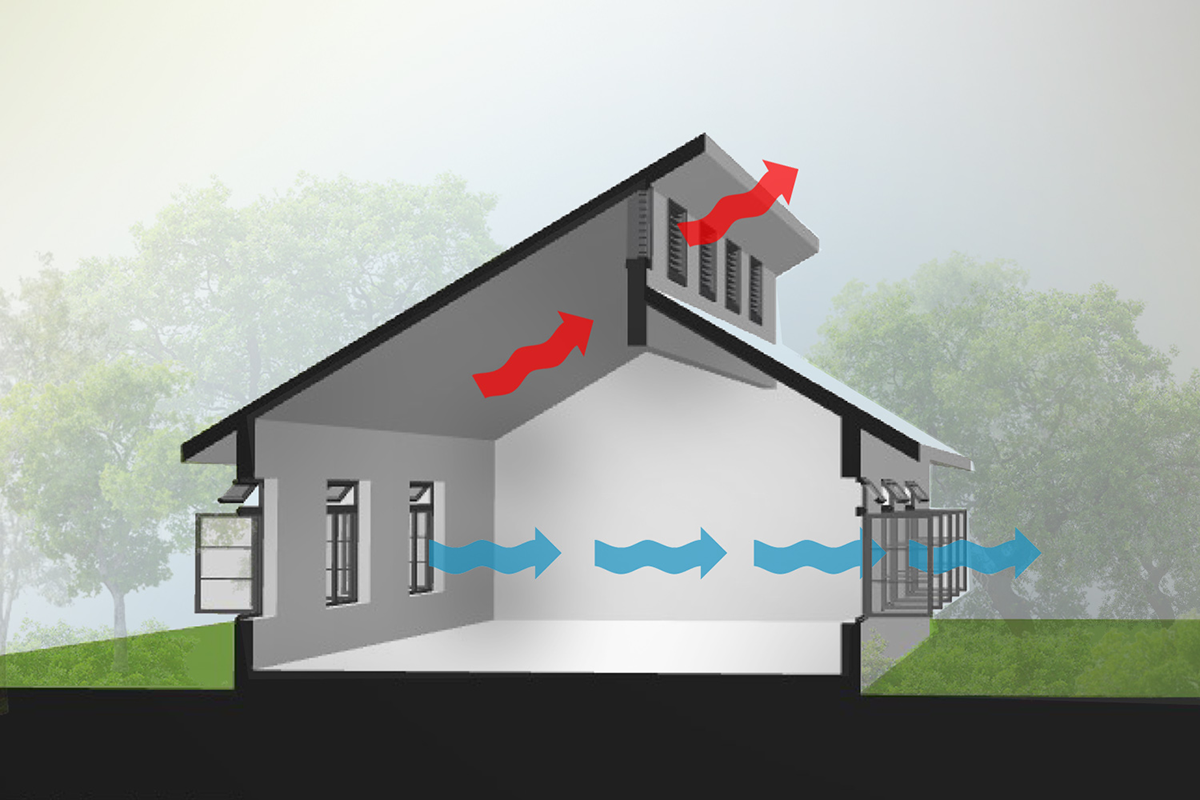

1. Reduction of energy requirements for heating.

2. The thermal improvement of the building (insulation, floors, windows, including fixtures).

3. The installation of solar panels.

4. The replacement of winter air conditioning systems.

Furthermore, the deduction is also available for:

- The purchase and installation of solar shading.

- The purchase and installation of winter air conditioning systems equipped with heat generators powered by combustible biomass.

- The purchase, installation and implementation of multimedia devices for the remote control of heating systems, hot water production or air conditioning of residential units.

- The purchase and installation of micro-cogenerators to replace existing systems.

- The purchase of condensing hot air generators.

- The replacement of winter air conditioning systems with hybrid devices consisting of a heat pump integrated with a condensing boiler.

The tax deductions must be divided into 10 annual installments of the same amount and vary based on whether the intervention concerns a single real estate unit or condominium buildings, as well as the year in which it was carried out.

An essential condition to benefit from the relief is that the interventions are carried out on existing real estate units and buildings of any cadastral category, including those instrumental for business or professional activity.

The relief is applicable to expenses incurred by 31 December 2021. For most interventions, the deduction is 65%, while for others it is 50%.

In particular, from 1 January 2018, the deduction is 50% for the following expenses:

- Purchase and installation of windows including fixtures and solar shading.

- Replacement of winter air conditioning systems with systems equipped with condensing boilers with efficiency at least equal to product class A (from 2018, systems with condensing boilers with an efficiency lower than class A are excluded from the subsidy). However, if in addition to being in class A, they are equipped with advanced thermoregulation systems, a higher deduction of 65% applies.

- Purchase and installation of winter air conditioning systems equipped with heat generators powered by combustible biomass.

Condominium interventions:

For interventions on the common parts of condominium buildings or which involve all the real estate units of a condominium, different rules, times and measures are envisaged. For expenses incurred from 1 January 2017 to 31 December 2021, higher deductions (of 70 or 75%) can be applied when certain energy performance indices are achieved. These deductions are calculated on a total amount not exceeding 40,000 euros, multiplied by the number of real estate units that make up the building.

For interventions on the common parts of condominium buildings located in seismic zones 1, 2 and 3, which aim to reduce seismic risk and improve energy efficiency, an even higher deduction is foreseen:

- 80%, if the works cause the passage to a lower risk class.

- 85%, if the interventions determine the transition to two lower risk classes.

For these interventions, the deduction is divided into 10 annual installments of the same amount but is applied to an amount of expenses not exceeding 136,000 euros, multiplied by the number of real estate units in each building.

Credit transfer and option for contribution in the form of a discount:

In accordance with article 121 of legislative decree no. 34 of 2020 (known as the Relaunch Decree), taxpayers who incur expenses for energy requalification interventions in the years 2020, 2021, 2022 and 2023 can opt for an alternative method to the direct use of the tax deduction due. The two options are as follows:

1. CONTRIBUTION IN THE FORM OF A DISCOUNT: In this case, the taxpayer can request a contribution, in the form of a discount on the amount due, up to a maximum amount equal to the amount itself. This contribution is advanced by the suppliers who carried out the interventions and subsequently recovered by the suppliers in the form of a tax credit. The taxpayer also has the option to assign this credit to third parties, including credit institutions and other financial intermediaries.

2. ASSIGNMENT OF TAX CREDIT: Alternatively, the taxpayer can opt for the assignment of a tax credit of the same amount. This tax credit can be transferred to third parties, including credit institutions and other financial intermediaries.

These options provide taxpayers with additional flexibility in exploiting the tax benefits linked to energy redevelopment interventions, allowing them to obtain an immediate economic advantage in the form of a discount on expenses incurred or through the transfer of the tax credit to third parties.